Business – Analysis of the Swiss watchmaking industry in 2014

The Swiss watchmaking industry is known to be a dream factory. If you’re a collector and a frequent reader of Monochrome-Watches, you certainly know what we mean by that. However, Swiss manufactures are also (actually mainly) businesses, with a unique goal: selling watches, achieving a worldwide recognition and creating value. In order to understand a bit more about this industry that we too often view only from the product side, here are some interesting figures about the year 2014.

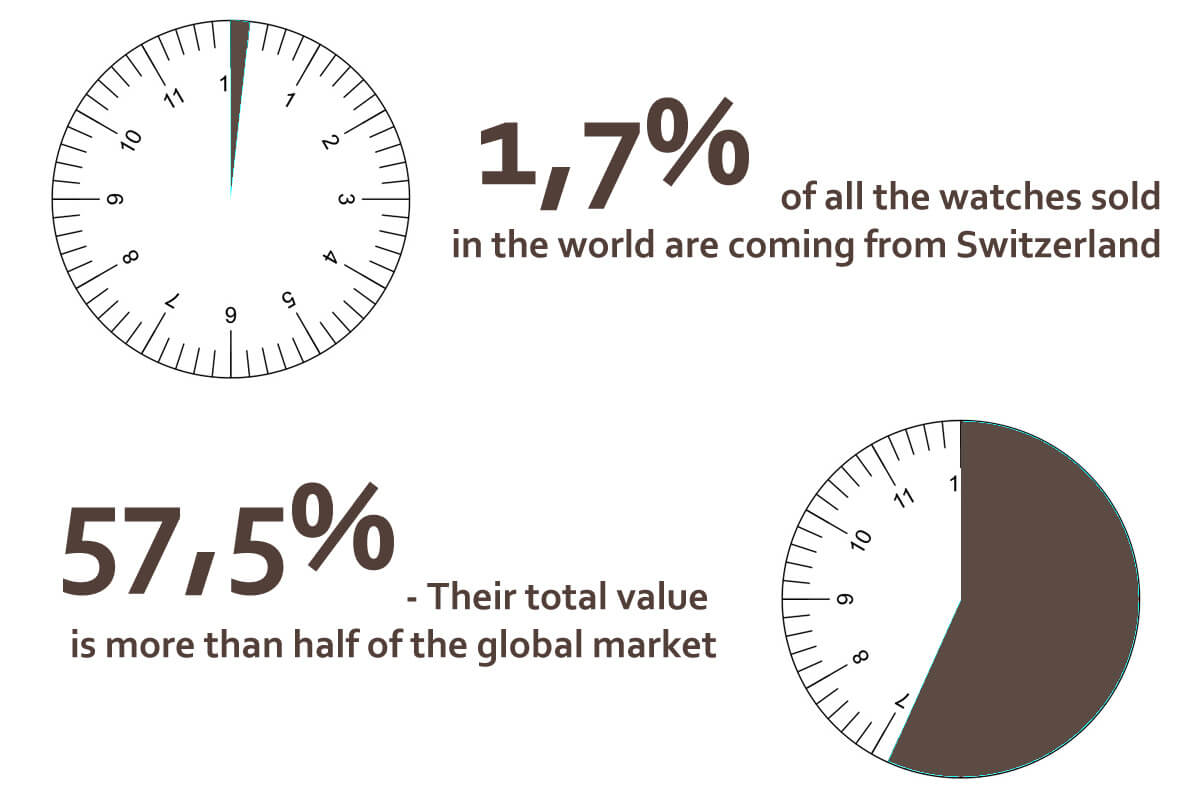

Let’s start immediately with the impressive numbers. While the production numbers of Swiss-made watches is almost insignificant as part of the entire annual watch production (which includes all vast numbers of cheap quartz watches produced in China), the value created by the Swiss manufactures is imposing. As the graph shows, Switzerland only produces one watch against fifty produced in the entire world. When you consider those numbers, just think that this small country is also responsible of more than half of the overall value created – 57,5% to be precise. Combined these graphs show the difference in terms of price between Swiss watches and watches from the rest of the world. On average Swiss-Made watches are eighty times more expensive than the watches produced in the rest of the world. For a better understanding of what the Swiss Made label means, see here.

These graphs also imply the strength of the Swiss industry on this market. Even when they produce a very limited numbers of watches, the Swiss watch industry literally rules the watchmaking world, drives the market and of course imposes its politics.

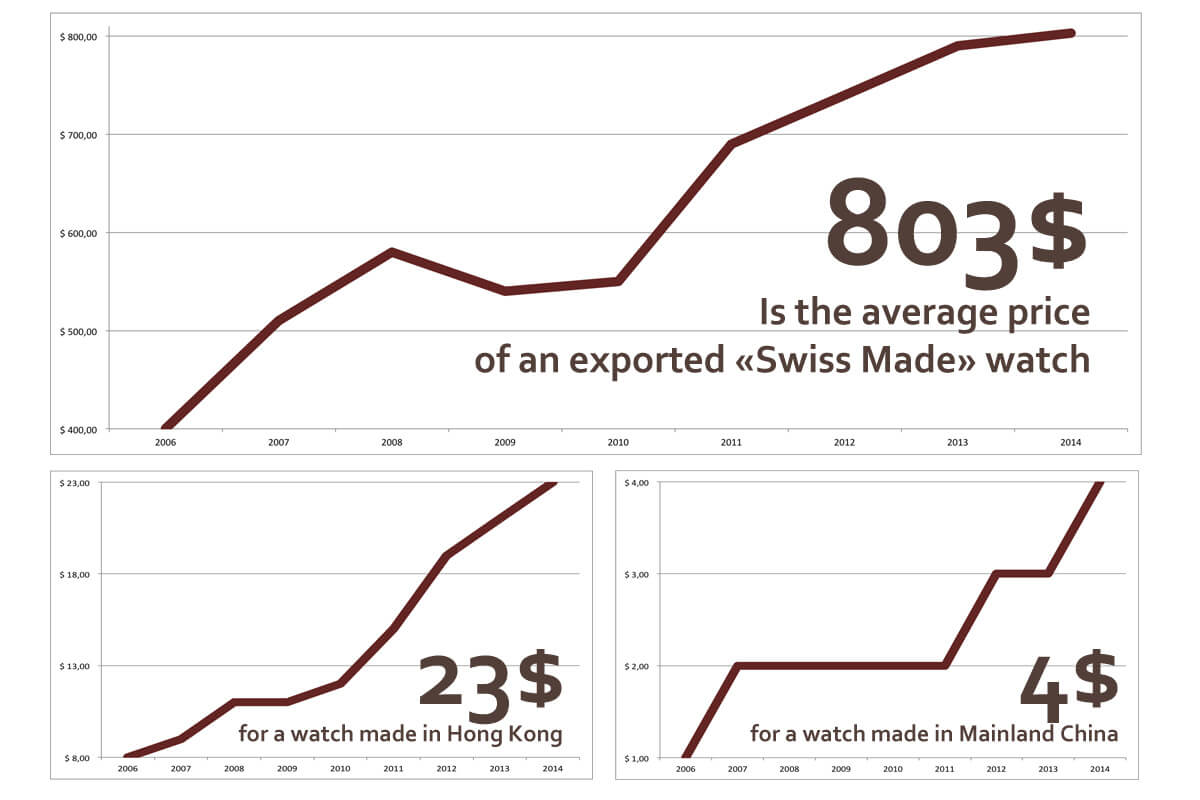

This second graph confirms the huge difference in terms of price, or added value, between Switzerland and the two other main producers: Hong Kong and mainland China. These figures have to be seen in the perspective that Switzerland is (almost) the only producer of high-end mechanical watches, while mainland China sells mass produced quartz timepieces.

A second thing that we can learn from these graphs is the staggering increase of the prices over the last ten years. It’s simple: the average price for a Swiss watch doubled, starting from approximately 400 USD in 2006 to 803 USD in 2014. Every year, the average price of Swiss-made watches increased by more than 10% – one exception for the year 2009, when the industry faced the effects of the financial crisis. The total number of Swiss-made watches sold in 2009 were lower AND the sold watches had (on average) a lower price.

How can we explain this impressive increase of the average price of the watches manufactured by the Swiss? Several explanations are possible. The first explanation is inflation. Usually, prices tend to grow from 2% to 4% each year. That’s a natural effect that no one can avoid. Another explanation could be a higher margin, that can be realized in a market driven by several emerging and/or rich markets (China, Russia, UAE…), that have been big outlets for the vast number of Swiss-made watches. Another explanation could be that the watches sold are more expensive because there’s a stronger interest in more complicated and more luxurious timepieces, increasing the average price of Swiss-made watches.

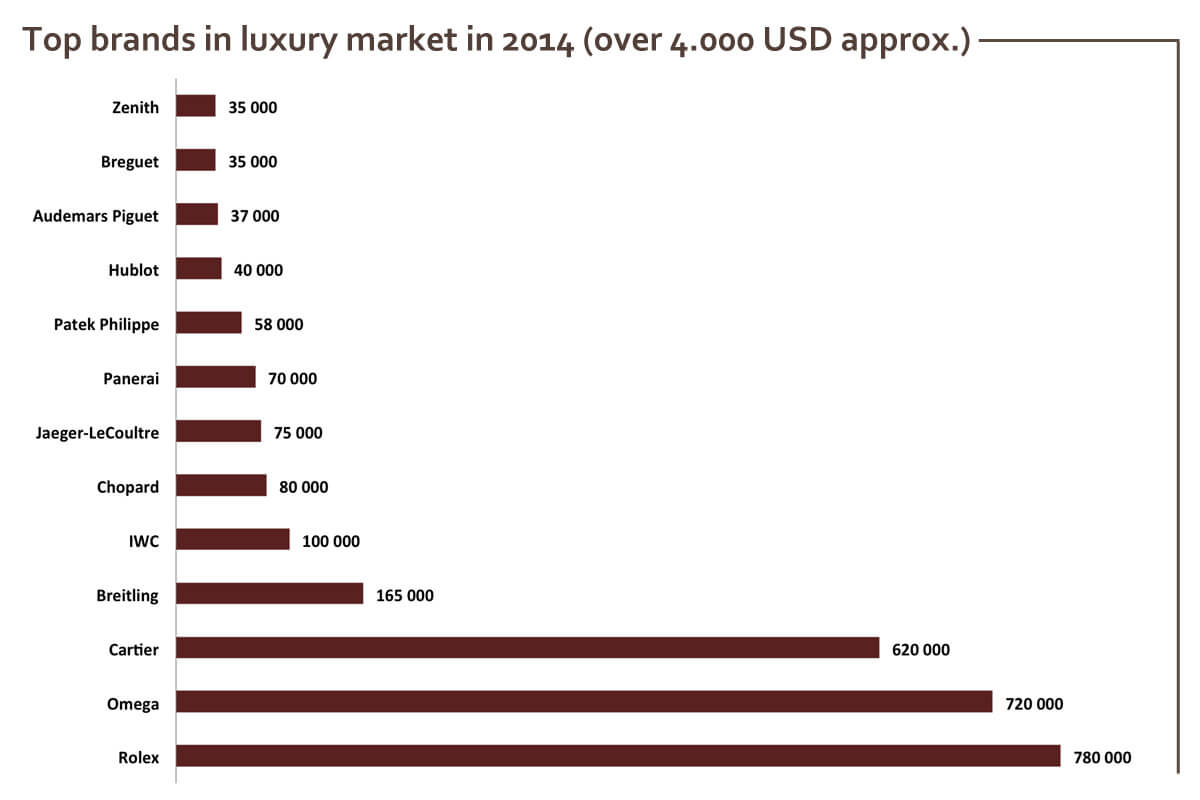

After our look on the overall market, let’s now have a view on the brands that make up for these numbers. In the luxury market (meaning: watches priced over $ 4,000 USD), you won’t be surprised to see that Rolex is still the main player, with 780.000 watches sold in 2014. However, its leading position is not as strong as it once was. Two other actors are now just behind Rolex: Omega and Cartier. If we’re looking at the market from a brand-side only, Rolex is still the biggest player. However, if we now look at it from a group-side, Rolex is far behind the Swatch Group – and the Richemont Group is now second.

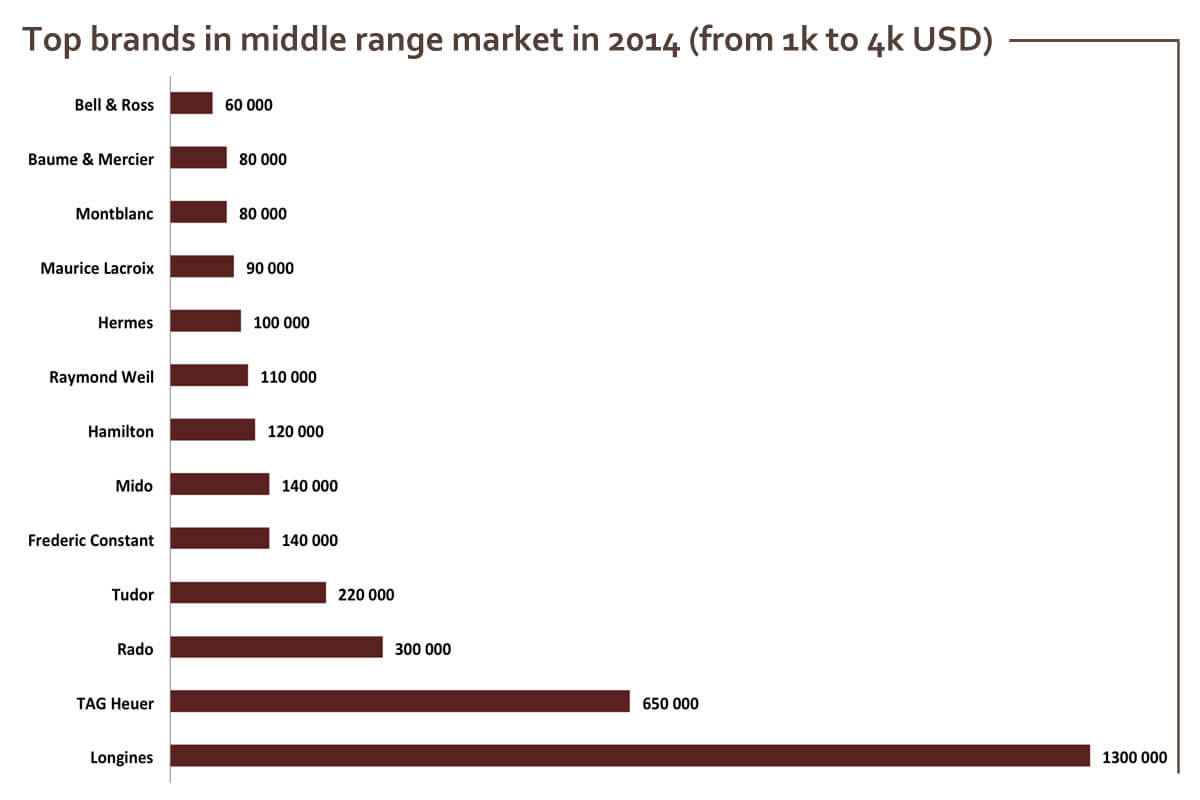

If we add other segments of the market (the middle range and entry level watches), without a doubt, the leader is the Swatch Group, who produce over 20 millions of timepieces in Switzerland (of which 12 million pieces for Swatch, 4.2 million for Tissot, 1.3 million for Longines, 300,000 for Rado, 720,000 for Omega, and another 2 million for Breguet, Blancpain, Go, Mido, CK Watches, Hamilton…).

The second largest group is far behind. Indeed, Richemont Group produces less than Swatch Group, however the production is essentially focused on high-end to ultra-high-end watches. If we include Cartier, IWC, Jaeger-LeCoultre, Panerai, Montblanc and Baume & Mercier, the numbers are already impressive, with over 1 million watches produced in 2014 (we should also include the watches from Lange & Söhne or Roger Dubuis, however production numbers are much lower than the rest of the Richemont brands, however with a much higher intrinsic value per piece).

Looking at Rolex as a group – and thus including Tudor – means looking at a strong, but not the strongest, manufacture, with approximately 1 million watches sold in 2014. This number remains very impressive, especially considering that the group is comprises only 2 brands – and Rolex may not be the strongest in terms of sales, they remain the most influential brand around the world.

Market data from LeTemps.ch and analysis by Monochrome-Watches.